Mr Originality, aka David Cameron, is at it again. With all the appearance of having found something outrageous that has gone unnoticed before, he has declared his intention of taking decisive action against benefit cheats. In his own words to an audience in Manchester today, he boldly stated:

"There are some people who are claiming welfare who are not entitled to it and that is just wrong and that should stop. Both things, fraud and error, go together and I want to cut them both."

Er - am I wrong in finding this all a little familiar? I seem to recall that back in the 1970s, newpapers like the Sun were always banging on about "Costa del Dole" and "Social Security Scroungers". It has been a recurring theme at Tory Party conferences for decades, yet they never seem to be able to eradicate the problem, or even reduce it. So what has the PM come up with? Well, as it says on the news, he's going to use private credit rating firms, offering them a dividend from the money they save in tracking down the cheats. As one firm, Experian, estimates that it can save £1 billion, that should make for a handsome profit.

What I wonder about is this: why hire private firms to deal with this problem when there already exists a full time, highly experienced force of Government employees to do the job? Or will they be joining the people they now investigate?

Tuesday, 10 August 2010

Subscribe to:

Post Comments (Atom)

Private firms have to make a profit as they are self funding and therefore work harder and more efficiently. They run slick operations that are geared to performance. A cost effective solution !

ReplyDeleteHaving worked for the DSS for 28 years, I do have some experience of both fraudsters and of private sector contractors doing public sector work.

ReplyDeleteFraudsters: an easy target for politicians who wish to grab headlines, the problem with fraud detection is that staff cuts have reduced its effectiveness. Politicians’ actions therefore don’t match their words. A lot of people get caught because they boast how clever they are, and annoyed neighbours, friends or relatives shop them. Then of course they moan about “snoops”. A woman I knew complained to me that her next-door neighbour was claiming benefit as a single parent but had an employed partner living with her. I said that if she gave the details, I’d make sure the relevant fraud section would hear about it without naming her. She was horrified, and this sums up the attitude of many people: why don’t “they” do something about it? My thought was “Why don’t you?”

When the clamp down happens, the fiddlers will find their way around the new rules and the stricter regime will simply cause more bureaucracy and red tape for ordinary claimants to negotiate as they make their claims. I saw this happen time and time again.

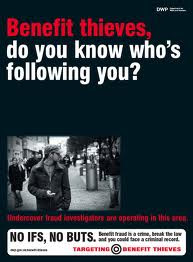

Benefit fraud is small beer compared to tax fraud, but fiddling your tax is apparently a respectable crime. The benefit fraud adverts are ludicrous to those who work in the DWP (as the DSS is now called).

Private sector involvement: a couple of years ago, the CSA privatised some work and, obviously, paid the firm to do it. The company contacted the CSA to say that their staff couldn’t process the work and be required to answer the phone at the same time. Welcome to civil service work! They got in such a mess that the CSA sent in staff to help them out, thus meaning they were paying to have this work done twice: once to the company and again to their own staff seconded to the company. So much for lean, mean, efficient private sector firms.

Private sector companies doing job centre work were given much simpler and lower targets than civil servants were. If you move the goalposts, then you can make anything look successful. These are a couple of examples - I could quote many more. My experience is that the private sector is not good at public sector work.

The ability of identifying a lean, efficient private sector company to subcontract work to is brought about in the procurement process. Securing an appointment on the basis of the right team, agreed costs, programme and appropriate transfer of risk is the responsibility of the client .

ReplyDeleteIf the company gets in a mess they should be back charged any costs and if the work is not completed on time liquidated damages should be enforced. The company should also demonstrate that it has a performance bond in place backed by a large insurance company in order that papers can be served upon them should it be necessary.

Unfortunately contracts with private firms can go wrong and those companies should not be allowed to tender in the future.

I agree Chas that in theory - if you are going to have privatisation - that is what should happen, but it doesn't, despite lengthy procurement processes which, with one privatisation, I was able to observe quite closely. With government procurement, the reward for failure is more contracts. The government has an ideological necessity to declare all privatisations successful. They prefer to cover up inadequacies, rather than publicise their mistakes.

ReplyDeleteConsequently, you end up with botched procurement & privatisations, all of which are proclaimed as triumphs by politicians who care more about not losing face than wasting money and messing up public sevices. That being so, you will rarely have a privatisation that succeeds; because of the failures, the taxpayer ends up paying more, although that too is covered up by the money coming out of a different budget.